Enrico Giacoletto, founder of easyReg

Who are you, Enrico?

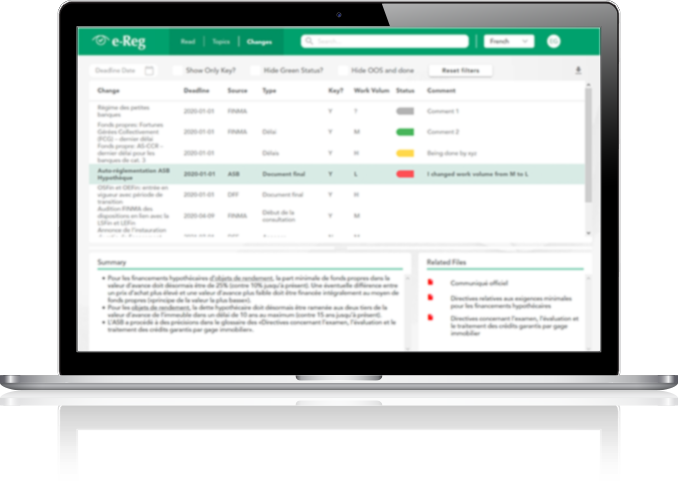

I founded easyReg in 2018 to host and develop my half-FinTech, half-LegalTech, but above all RegTech creation, the e-Reg platform.

I fell into the world of financial regulation some time ago. I was the Financial Servive Risk Management leader for Romandie in a Big 4.

I experienced the frustrations and lack of tools that come with working with regulations. This is the daily lot of most professionnals who must work with regulatory texts.

With 22 years’ professional experience in the financial industry, I have acquired a global vision of risk management and governance processes. I know the regulatory agenda. I have helped many clients with regulatory issues, particularly private banks based in Lugano and Geneva. These assignments involve both risk management and the implementation of regulatory changes.

How and why did you set up easyReg?

I’ve spent a lot of time in the field of banking regulation.

- I’ve had to deal with the usual difficulties, at a time when the volume of regulatory information is constantly increasing, which adds to the complexity of compliance.

- I’ve experienced the frustration of wasting far too much time looking for the right regulations as part of my consultancy work.

I also have a strong technical background, thanks to my background as a communications systems engineer, with IT options.

Combining my experience of regulation and compliance with my geekside, I came up with the idea of developing a Swiss RegTech 2.0 tool. That’s how I came up with the digital platform e-Reg.

I’m doing my part to address the existing situation, with solutions based on new technologies. With RegTech, I am contributing to simplifying search and regulatory management.

“With my understanding of IT and what can be done with it, it was shocking that we were “Ctrl F” in PDFs to search for information. When we could understand and digitise regulations, use links, enable search into the past, present or future, and build a database that could be used for many more things.

Tell us about the first customer for your RegTech e-Reg application?

At the start of 2019, various financial organisations quickly contacted me for consultancy assignments. I carried them out with the help of the technologies exploited by my RegTech application. All these companies, my first customers, helped me to finance the development of the platform.

e-Reg recorded its first SaaS subscription sale on 7 April 2021, in the middle of Covid-19.

Why is e-Reg a scalable RegTech solution for regulatory research and management?

Jean Rostand once said that “to wait until you know enough to act is to condemn yourself to inaction”. e-Reg is therefore moving forward in an agile mode.

The growth of my company and the development of the e-Reg platform have been a step-by-step process, driven by user requests and suggestions. The last few years have seen :

- improved reporting and generation of reports in the tool in 2022;

- addition of internal policies for e-Reg customer companies (from February 2024).

Want to discover other facets of Enrico?

Read his answers to the Proust questionnaire.